ATOM Financial Aid

Loan Management

Loan Management

ATOM is committed to offering a quality education at a reasonable cost.

In an effort to manage

student indebtedness, ATOM encourages students to explore a variety of funding sources for

their education. In instances where other funding sources are limited or do not exist and students choose to fund their ATOM education through student loans, ATOM encourages students to engage in careful budgeting.

Good financial management before, during, and after enrollment can keep overall debt within reasonable limits.

Budgeting

The Financial Aid Office is available to help advise students on how to develop a personal budget. Careful budgeting can help minimize the amount a student needs to borrow.

Budgeting and Borrowing Overview

Source: 2012 US Dept. of Education Federal Student Aid Conference

Master’s Level Menu

DAOM Level Menu

Resources

Federal Student Aid

Money Managing Tools

Fanaid

need to be created as link

Loan Repayment

Selection of the appropriate repayment plan for Direct Loans is essential, and can save money in the long run.

Payment plans should be selected during the grace period. Borrowers who do not select a payment plan are automatically enrolled in the Standard (10 Year) Repayment Plan. To enroll in a different repayment plan, borrowers should contact their loans servicer. To find out who your loan servicer is, visit your account dashboard and scroll down to the “My Loan Servicers” section, or call the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

The repayment plans outlined below are available for federal Direct Subsidized, Unsubsidized, and PLUS loans for graduate students. If you need assistance selecting a repayment plan, please contact the loan service.

make the bold words into links except essentials

Fixed Plans

Eligibility

Monthly Payments

Standard

These loan types are eligible:

Direct Subsidized and Unsubsidized Loans

Subsidized and Unsubsidized Federal Stafford Loans

All PLUS loans (Direct or FFEL)

All Consolidation Loans (Direct or FFEL)

Payments are a fixed amount that ensures your loans are paid off within 10 years (within 10 to 30 years for Consolidation Loans).

Graduated

These loan types are eligible:

Direct Subsidized and Unsubsidized Loans

Subsidized and Unsubsidized Federal Stafford Loans

All PLUS loans (Direct or FFEL)

All Consolidation Loans (Direct or FFEL)

Payments are lower at first and then increase, usually every two years. Payment amounts are designed to ensure your loans are paid off within 10 years (within 10 to 30 years for Consolidation Loans).

Extended

To qualify for this plan, you must have more than $30,000 in outstanding Direct Loans (if you’re a Direct Loan borrower) or more than $30,000 in outstanding FFEL Program loans (if you’re a FFEL borrower). These loan types are eligible:

Direct Subsidized and Unsubsidized Loans

Subsidized and Unsubsidized Federal Stafford Loans

All PLUS loans (Direct or FFEL)

All Consolidation Loans (Direct or FFEL)

Payments can be fixed or graduated and will ensure that your loans are paid off within 25 years.

Income Driven Repayment Plans

Eligibility

Monthly Payments

SAVE Plan

10% of discretionary income These loan types are eligible:

Direct Subsidized and Unsubsidized Loans

Direct PLUS Loans made to students

Direct Consolidation Loans that do not include PLUS loans (Direct or FFEL) made to parents

10% of discretionary income

10% of discretionary income

PAYE Plan

To be eligible, you must be a new borrower on or after Oct. 1, 2007, and must have received a disbursement of a Direct Loan on or after Oct. 1, 2011. These loan types are eligible:

Direct Subsidized and Unsubsidized Loans

Direct PLUS Loans made to students Direct Consolidation Loans that do not include PLUS loans (Direct or FFEL) made to parents

10% of discretionary income but never more than what you would pay under the 10-year Standard Repayment Plan

IBR Plan

These loan types are eligible:

Direct Subsidized and Unsubsidized Loans

Subsidized and Unsubsidized Federal Stafford Loans

Direct and FFEL PLUS Loans made to students

Direct or FFEL Consolidation Loans that do not include PLUS loans (Direct or FFEL) made to parents

Either 10% or 15% of your discretionary income (depending on when you received your first loans) but never more than what you would pay under the 10-year Standard Repayment Plan

IBR Plan

These loan types are eligible:

Direct Subsidized and Unsubsidized Loans

Direct PLUS Loans made to students

Direct Consolidation Loans (including those that repaid parent PLUS loans)

The lesser of

20% of your discretionary income, or

the amount you would pay on a repayment plan with a fixed payment over 12 years, adjusted according to your income

Loan Consolidation

Direct Consolidation Loans allow borrowers to combine one or more of their Federal education loans into a new loan.

The process of consolidation offers several advantages, including:

Single loan with one monthly bill

Lower monthly payments

Access to repayment plans and forgiveness programs

Weighted interest rate may reduce your interest rate

There may also be some disadvantages to consolidation, including:

Longer repayment period

Pay more interest overall and make more payments

Unpaid interest is added to principal balance

Loss of certain borrower benefits

Loss of qualifying payments toward IDR plan forgiveness

For more information about the Loan Consolidation Program contact your lender or the current holder of your loan(s) or to apply for a Direct Consolidation Loan online or by phone (1-800-557-7392).

Repayment: How to Manage Your Student Loans

To obtain resources, tools, repayment information and financial counseling log sign in at

Federal Student Aid Estimator | Federal Student Aid. The Federal Student Aid Estimator provides an estimate of how much federal student aid you may be eligible to receive. These estimates are based on the Student Aid Index (SAI), an index to determine federal student aid eligibility.

Follow the link below to use the student loan calculator from the U.S. Department of Education’s office of Federal Student Aid. Remember, to estimate your monthly payments, you must know your loan interest rate. Click on the Federal Interest Rates and Fees | Federal Student Aid link to get the current interest rate. The Loan Simulator can also help current loan borrowers estimate payments and simulate certain scenarios.

The Versatile Student Loan Calculator: Loan Simulator – Federal Student Aid

bold letters should be change as link to connect on a page

HHS Poverty Guidelines for 2023-2024

HHS Poverty Guidelines for 2023

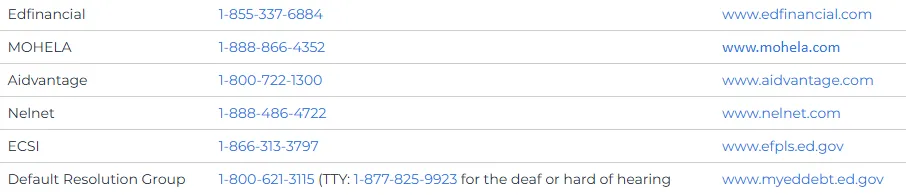

Accessing Your Loan Accounts

Direct Loan Account Access

Any Loan Servicer provides the repayment options available. It is important to keep their contact information available should you ever need to request postponing repayment by a deferment or forbearance at any time.

image needed to be change

The Office of the Ombudsman is the mediator acting on behalf of the student and the loan servicer. The Federal Student Aid Ombudsman Group of the U.S. Department of Education is dedicated to helping resolve disputes related to Direct Loans, Federal Family Education Loan (FFEL) Program loans, Guaranteed Student Loans, and Perkins Loans. The Ombudsman Group is a neutral, informal, and confidential resource to help resolve disputes about your federal student loans. If a servicer does not abide by offering repayment options to a borrower, the borrower should contact this office to mediate on behalf of the student to resolve the issue.

The Federal Student Aid Ombudsman Group recommends gathering certain information prior to first contacting them.

bold letters should be change as link to connect on a page

Postal Mail

U.S. Department of Education

FSA Ombudsman Group

P.O. Box 1854

Monticello, KY 42633

Phone

1-800-433-3243

Fax

606-396-4821

About ATOM

The Atlantic Institute of Oriental Medicine (ATOM) is more than just a school; it's a vibrant community built on a shared passion for Traditional Chinese Medicine (TCM).

At ATOM, we're committed to preparing the next generation of TCM practitioners to excel in an ever-evolving healthcare landscape. Our graduates are known for their profound knowledge, adaptability, and unwavering commitment to patient well-being. We provide a supportive and nurturing space where students can develop their skills, embrace their potential, and embark on a fulfilling career path.

Quick Links

ATLANTIC INSTITUTE of

ORIENTAL MEDICINE

100 E. Broward Blvd., Suite 100,

Fort Lauderale, FL 33301

ACAHM does not accredit any programs at the undergraduate/bachelor level.

STUDENT LIFE

PATIENT CARE

Hours of Operation

Monday 9am-5pm

Tuesday 9am-9pm

Wednesday 9am-5pm

Thursday 9am-5pm

Friday 9am-5pm

Saturday 9am-5pm

NEWS

LEGAL

© Copyright 2026. Atlantic Institute of Oriental Medicine. All Rights Reserved.